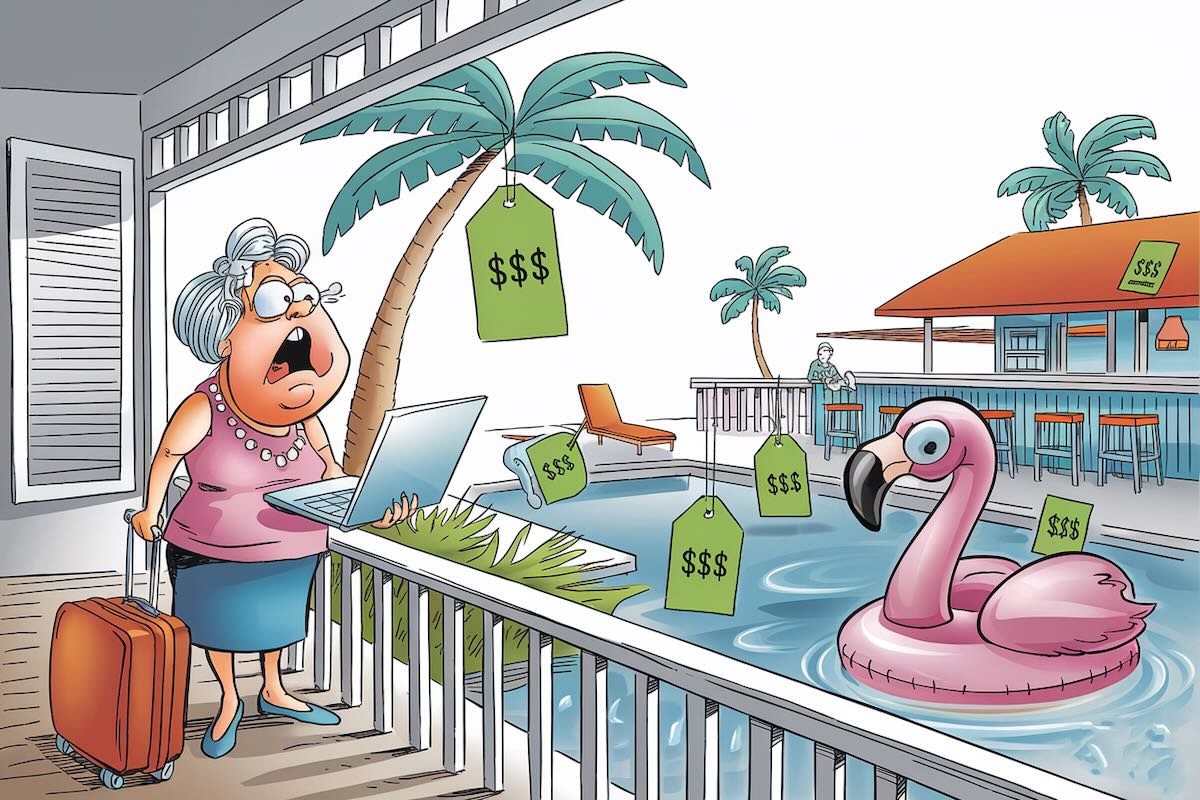

Can you afford your next vacation?

Be honest.

If you said no, you’re in good company. Last year’s big travel trend was the “justified vacation” or “justi-vacation,” which is when someone takes a vacation despite not being able to afford it. In a survey conducted by Allianz Partners, 47 percent of Americans said they couldn’t afford a vacation, but a majority of them traveled anyway.

Another survey by Bankrate found more than 1 in 3 travelers were willing to go into debt to pay for it.

“Taking on debt to pay for a vacation is not a smart decision,” says Steven Kibbel, a certified financial planner. “Credit card interest rates are high, typically 20 percent or higher.”

That means your dream vacation could cost you a lot more than you bargained for.

Look, people have been going into debt to finance their vacations since there have been vacations. But now they’ve gone too far. Americans owe more than $1 trillion in credit card debt, driven in part by a voracious appetite for miles. And many see putting their vacation on plastic as a “win-win” — they get the instant gratification of a trip now, plus “free” miles they can use for a future trip.

Going into debt for a vacation is not the best idea. It’ll hurt your finances, stress you out and probably leave you in need of another vacation. There are much better ways of dealing with a trip you can’t afford.

“Never, ever, ever go into debt to travel,” says Suzanne McConaghy, an expert on travel finances. “Make a plan, set a goal, save your money — and then go.”

OK, but why?

Why going into debt to travel is crazy

The allure of a picture-perfect vacation, often fueled by social media, can quickly lead you astray. Admit it, those images of Instagrammers enjoying a five-star resort, paid for entirely with “free” miles, is irresistible.

It’s also a lie.

There’s no such thing as free. True, travel hackers are racking up points and miles with each debt-funded stay. But they’re also playing a dangerous game. If you don’t pay off your balance in full every month, the interest charges will quickly negate the value of any rewards you earn. It’s a fool’s errand.

“Taking on any form of debt can significantly increase your stress levels,” says Jeremy Clubb, founder of Rainforest Cruises, a tour operator that specializes in riverboat and small ship cruise packages in the Amazon and Southeast Asia. “That often outweighs the relaxation and mental wellness travel is meant to provide.”

I interviewed dozens of travelers for this story, some of whom insisted that taking on debt to travel was sometimes justified. They said for special occasions or once-in-a-lifetime events like a honeymoon, it is indeed appropriate to go into the red. Some even claimed the points made it all worthwhile.

To which I say: nonsense! In fact, the more special the occasion, the more financially conservative you ought to be. Who wants to spend the first year of your marriage drowning in debt?

How do you afford a vacation, then?

I’m going to give it to you straight: The best way to ensure a stress-free vacation is to live within your means.

“Try being more creative about how you travel,” says Jeremy Murchland, president of Seven Corners Travel Insurance. “For starters, think about why you want to travel. Unless your heart is set on a certain destination, you might find some alternative ways to achieve your vacation goals without setting yourself back.”

In other words, plan ahead and explore alternative options that don’t require going into debt.

I know the travel advisors of the world will hate me for saying this, but maybe consider a staycation, visit local attractions, or take a road trip to a nearby destination.

But what if you want to go somewhere pricey?

Mitch Krayton, a professional travel advisor from Denver, says you should save for a big trip.

“Sweep $100 to $200 a week automatically from your checking into a special checking account,” he advises. “When you are ready to travel, you book with cash in hand. You not only will feel better that you can afford the trip, but you won’t have the letdown a month after you come home to a large bill.”

Don’t spend more than you have. It’s that simple.

Μaybe you need a vacation budget

There are two types of travelers: Those who spend as little as possible and those who don’t know the meaning of the word “budget.”

If you’re in the latter group, listen up: One of the best ways to avoid overspending is to create a budget. Apps like TravelSpend or Trabee allow you to visualize your expenses, track them, and plan your trip so that you don’t spend too much.

If you don’t want to use your smartphone on vacation, you can always invite a friend who is in the latter group — those who never spend. (That would be my brother.) They can spend the entire trip telling you, “no.”

And if you are in the former group, this story is not for you. You will never overspend on your vacation. I should have interviewed you for this article.

Other ways to avoid vacation debt

OK, how else can you steer clear of vacation debt? Here are a few ideas:

- Take a staycation. Spend a week exploring your own town. You might be surprised at what you discover. “Staycations can sound horrible,” says Sam Hohman, CEO of Credit Advisors Foundation. “But if as much planning goes into them as a destination vacation, they can be really memorable and personally restorative.”

- Travel during the off-season. “Anywhere you desire to see is going to be just as great during its off-season,” says Christopher Falvey, co-founder of Unique NOLA Tours. “But it will be less crowded and less expensive.” So you get the same experience for less — just because you waited a few weeks.

- Abbreviate your vacation. “If all you just need is a break – and who doesn’t? – figure out how you can enjoy time off without it costing you much money,” says Erica Sandberg, a consumer finance expert at CardRates.com. For example, a weekend getaway instead of a two-week adventure may be enough to recharge your batteries. And it’ll save you time, too.

So, the next time you’re tempted to book that dream vacation on credit, remember this: A trip paid for with debt is a trip you can’t afford. Instead, focus on saving and planning. You’ll enjoy your vacation more knowing you’re not coming home to a mountain of bills.